Forex Megadroid - The Basics Of Forex Megadroid For Your New Users

Forex Megadroid - The Basics Of Forex Megadroid For Your New Users

Blog Article

Domain appraisal route in the current diverse market situation is a big challenge. Sometimes it is hard or even impossible to leave out the subjective opinion and just stick to the facts and statistics.

You can use it even if you have no knowledge of Ethereum price prediction 2026 how foreign trading works this is due to the fact that it is a plug and play software. It has a manual inside its member's area which you can use to learn how to use the software.

The next one I tried was a complete bust! The person was completely ambiguous and offered absolutely no insight into what i was asking. It dragged on until the free time ran out and then came the push to ante up. Needless to say, I did not offer anything up, again i moved on.

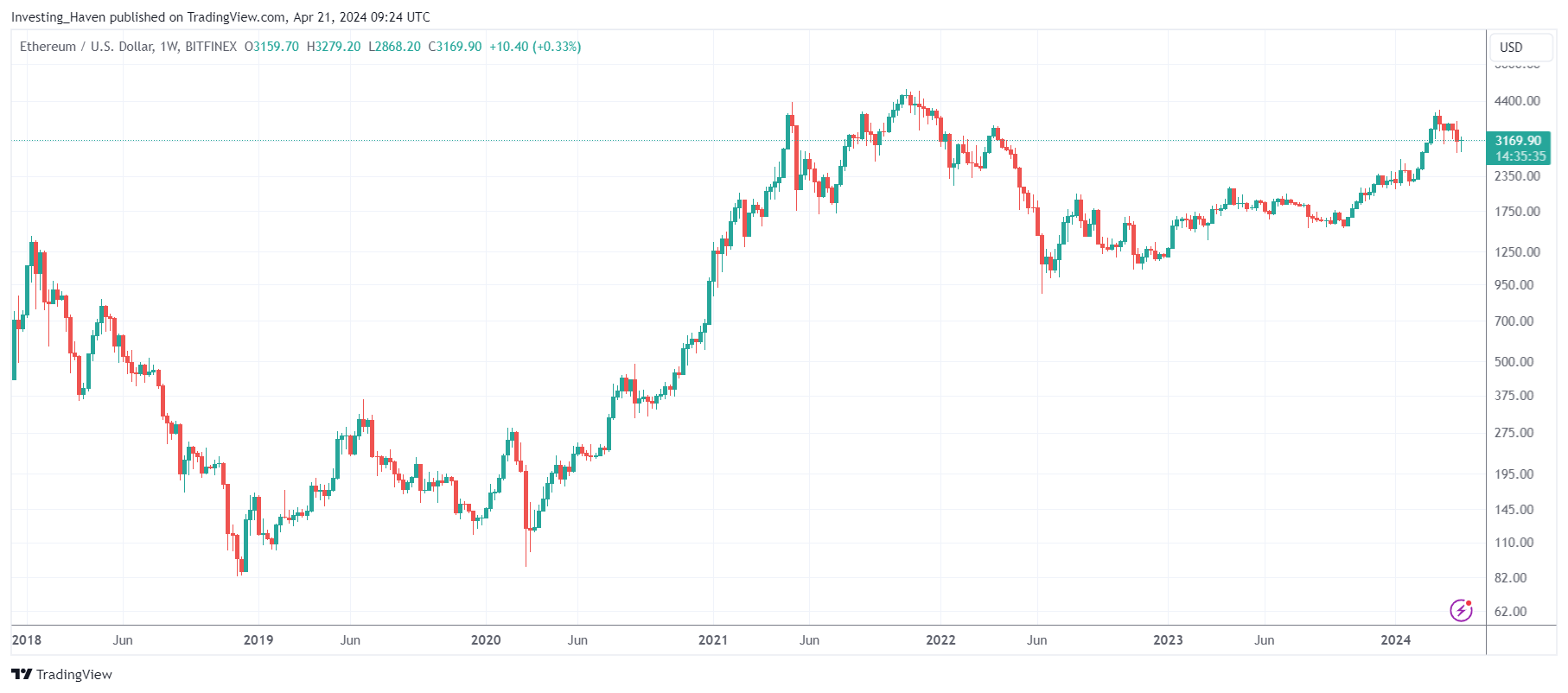

As they looked at the weekly chart Peter continued Bitcoin price prediction 2025 We know that the monthly trend is down this weekly chart shows the most recent leg down that may have brought in the low for this bear market. The remaining 30% of my Stock market allocation is used to trade shorter term trends using both this timeframe and the daily chart.

Paul could see now the reason for his huge losses. He had looked at charts before but he had never looked at the big picture. The monthly chart showed the trend clearly - Dogecoin price history and future trends it had been down. A simple moving average crossover sell signal would have saved his fortune...

It is being predicted by many market analyst that gold prices Solana Price History can reach $2,200 per ounce in 2012. This is in fact a conservative prediction. There are some market analyst who are bullish and say that gold prices can reach as high as $3,000 per ounce in 2012. Now, this can be a bold prediction. But most including Morgan Stanley is putting their reputation on the line by predicting that the gold price will hit $2,200 per ounce in 2012.

After this gain, I realized the value of following an asset closely and recognizing how certain changes, whether its financial news or quarterly results figures, impact the price movement. By gaining this insight over a defined period of time, it helped me to realize a gain.

So where is the risk part? Well, what if the price of silver had actually dropped? You paid $1 for the contract to buy at $18/ounce. Suppose the market price now becomes $15/ounce. Obviously you will not buy silver now at $18/ounce, so your options contract will simply become worthless. Thus you have lost your $1 and made nothing. So you see how options trading is a double edged sword but with the right strategy, you can make a good amount of money.